Aside from buying a home, a car is probably the second-most expensive purchase you will ever make and most of us only do this every 5 – 10 years.

With the average length of car ownership at about 8 years, car owners should be mindful of ways to improve their car’s longevity. Using the below tips, you can extend your car’s lifespan and enjoy it for more miles on the road.

Insurance protection can help protect your investment and your vehicle for the long haul. Members Trust partners with a dedicated team of insurance professionals to bring you a variety of quality insurance products so that you can protect what matters most to you!

We are rolling out new Guaranteed Auto Protection (GAP) and Mechanical Breakdown Protection plans that provide members with robust, affordable coverage options that beat dealership pricing.

Guaranteed Auto Protection (GAP)

Guaranteed Asset Protection (GAP) helps cover the remaining balance on your loan if you experience a total loss before it is paid off.

Most insurance policies only cover the actual cash value of your asset. As a result, there can be a substantial “GAP” between your loan or lease and the amount your insurance company pays to replace your vehicle.

GAP settles the difference between your primary insurance settlement and your remaining loan balance at the time of loss. GAP may also cover your primary insurance deductible.*

| GAP EXPLAINED** | |

| Loan balance at the time of loss | $23,000 |

| Value of the vehicle at the time of loss | $19,000 |

| Less insurance deductible | -$1,000 |

| Primary insurance settlement | $18,000 |

| Difference owed | $5,000 |

| Your potential out-of-pocket expense with GAP | $0 |

Members Trust GAP Protection is a very affordable, one-time premium that can be rolled into your auto loan financing. That’s affordable peace of mind!

Learn more about GAP protection or contact us to discuss your options.

*Subject to the terms, conditions, limitations, and exclusions set forth in your contract. **This example is for illustrative purposes only.

Mechanical Breakdown Protection Plans

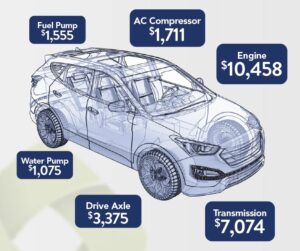

The vast majority of costly mechanical and electrical failures occur AFTER the factory warranty has expired.

Avoid expensive repairs by protecting your vehicle with a Mechanical Breakdown Protection contract. Your vehicle is not only an investment; it’s your transportation lifeline. Members Trust offers a protection plan through ASG, to give you peace of mind knowing your investment is protected.

Avoid expensive repairs by protecting your vehicle with a Mechanical Breakdown Protection contract. Your vehicle is not only an investment; it’s your transportation lifeline. Members Trust offers a protection plan through ASG, to give you peace of mind knowing your investment is protected.

There are four different yet affordable coverage options, designed to protect your investment and reduce out-of-pocket expenses should a mechanical breakdown occur.

In addition, all four protection plans provide these additional benefits to our members.

In addition, all four protection plans provide these additional benefits to our members.

Roadside Assistance

The emergency services include:

- Towing

- Lock-Out Assistance

- Fuel Delivery

- Flat Tire Assistance

- Battery Service

Rental Vehicle

In the event of a covered mechanical breakdown, you will be eligible for alternate transportation according to the schedule in your contract.

Tire Road Hazard

If your vehicle’s tires are damaged due to a road hazard, you are eligible for repair or replacement throughout the life of the contract.

Trip Interruption

If a mechanical breakdown occurs more than 100 miles away from your home and results in a repair facility keeping your vehicle overnight, you are eligible for reimbursement of meals and lodging for up to three days.

EASY AND AFFORDABLE

With these breakdown protection plans, the repairs can be done at any licensed repair facility in the US or Canada and claims are paid directly to the repair facility. Plus, coverage may be transferred if you sell your vehicle before your contract expires, which makes your resale more valuable!

These protection plans can be added to any vehicle, at any time, even if you don’t finance your loan at Members Trust (but why wouldn’t you)!

Learn more about Mechanical Breakdown Protection or contact us for a quote.

*The above is for illustration purposes only and is based on average repair and replacement costs. Actual costs may vary.