The credit union movement began with a simple idea – that people could achieve a better standard of living for themselves and others by pooling their savings and making loans to neighbors and co-workers.

Credit Unions were originally formed to “promote thrift among its members.” This “not-for-profit philosophy” still exists today to encourage thrift among members, create a source of fair credit at a fair and reasonable cost, and provide an opportunity for its members to improve their economic and social conditions.

At Members Trust, we want to help members be financially successful by being thrifty and setting long-term financial goals. Most people have experience with saving for short-term financial goals, whether it’s a nice shirt or a down payment on a car. However, fewer people have taken the time to set out a specific long-term financial goal.

That’s understandable since planning out long-term financial goals and making them specific, time-bound, and measurable can be a bit intimidating. However, setting financial goals won’t just make you more likely to achieve them—it will also improve almost every aspect of your life.

Why Set Financial Goals?

- Gives you direction

When you set a financial goal, you give yourself (and your money) a purpose. It forces you to think about what you want financially and prioritize your expenses. If you haven’t taken the time to clearly set out your financial goals, you’re more likely to spend money on things that seem nice at the time but ultimately don’t help you reach your goals. Once you have a clear goal in mind, you’re less likely to splurge on something that catches your eye.

- Compounds your returns

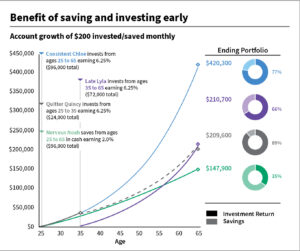

Preparing and saving for retirement takes time so it’s important to start that process early. Though retirement may seem far off for you, saving for it as early as possible will ensure you have enough money to get through your retirement years. In addition, investing early benefits from compounding returns, which will increase your money more over a longer period of time.

*Savings, investments and earnings are not guaranteed and are for illustration purposes only.

- Provides flexibility

Putting off saving for retirement later in life means that you’ll have to set aside a lot more money from your paycheck to reach your retirement savings goals and have enough money to carry you through your retirement. Setting aside $100 per month versus $1,000 can make a big difference in managing your day-to-day expenses. And don’t forget about the benefits of compounding!

- Keeps you accountable

Setting a specific financial goal means that you have a plan and are sticking to it. For example, each day you make a conscious decision that instead of spending $5 on coffee, you will put that $155 per month into your retirement savings account.

- Maintains motivation

When you set incremental benchmarks to reach your larger goal, it keeps you motivated to continue. For example, set a monthly goal to save a certain amount and when you reach these smaller benchmarks, it gives you a boost to keep going.

Any financial goal requires discipline, patience, and a little sacrifice. But there’s no better feeling when you hit your goal. It’s a boost to your confidence and makes it easier to set and achieve another financial goal. We’ve got just the right savings account to help you reach your short and long-term financial goals. Got a question about how to save for your financial goals? Talk to us!