Buying a home can be a daunting and time-consuming process especially for first time home buyers. If you are starting the home buying process, it’s helpful to have a few tips to help navigate the process.

Top 10 tips for first-time (or any) homebuyers.

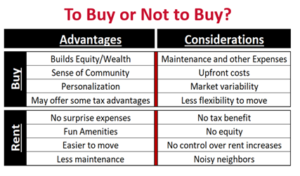

- Know the pros and cons of buying vs. renting and make sure you are ready to commit to a loan.

- Know how much house you can afford. Think about your salary and how much down payment you plan to make to see how much you can reasonably afford. A good rule of thumb is spending no more than 28% of your income on housing-related payments each month. So, if you have a monthly income of $5,000 per month, your mortgage payment should be no more than $1,400 per month.

- Get pre-qualified for your mortgage loan. It can be very tempting to jump into house hunting because that’s the fun part but it’s better to get pre-qualified before you start shopping. A prequalification is an estimate of the amount of home loan you can get. It’s based on an informal evaluation of your income and other information. This will help you stay on budget and only look at homes that you can afford.

- Maintain your credit. Your credit score is one of the key factors that determine whether you qualify and what your rate will be. Focus on paying down your debt and paying all your bills on time. Now isn’t the time to apply for new credit.

- Save for your down payment and closing costs. Your down payment shows the lender that you have some “skin in the game.” The more you save, the lower your monthly mortgage payment. Your closing costs can range from 2-6% of your loan amount so be sure to keep that in mind, as well.

- Create a wish list versus the non-negotiable things. Understand, there is no perfect home so make a list of the 3-5 things that matter most to you. Is it price, location, size of the home, school district, etc.? Find those things and then look at what you can do to CREATE your dream home.

- Work with a real estate agent or REALTOR® to find the perfect property. Agents and REALTORS® are local professionals who are experts in the home buying process and your local market. Interview your realtor to find out:

- Does their experience align with your needs/wants?

- Do they know the areas you are looking to buy?

- How many homes have they sold in the past 12 months?

- Make a strong offer once you are confident you’ve found “the one.” In a competitive market, you may consider offering more than the asking price or limiting your contingencies. Your realtor should help you think through this process and put together a competitive offer.

- Hire an inspector to help identify any issues with the home. You can use the results of the inspection to learn more about the home and request concessions from the seller.

- Prepare for your closing. This is where you sign all the papers to homeownership! You will probably do a final walk-through of the property to see if any issues need immediate attention. Compare your loan estimate to the disclosure and check for errors/changes. Sign the paperwork, pay what is owed and the keys are yours!

Members Trust is ready to help on your first-time home buyers journey. We have seasoned professionals available to help answer your questions, as well as first-time homebuyer programs available. Working with a trusted mortgage professional is important! Contact us to start the process.